Tech Monopolies Rule

The MANATee Monitor - Curated news and actionable advice for employees of the new FAANGs: Microsoft, Meta, Apple, Nvidia, Alphabet, Amazon & Tesla

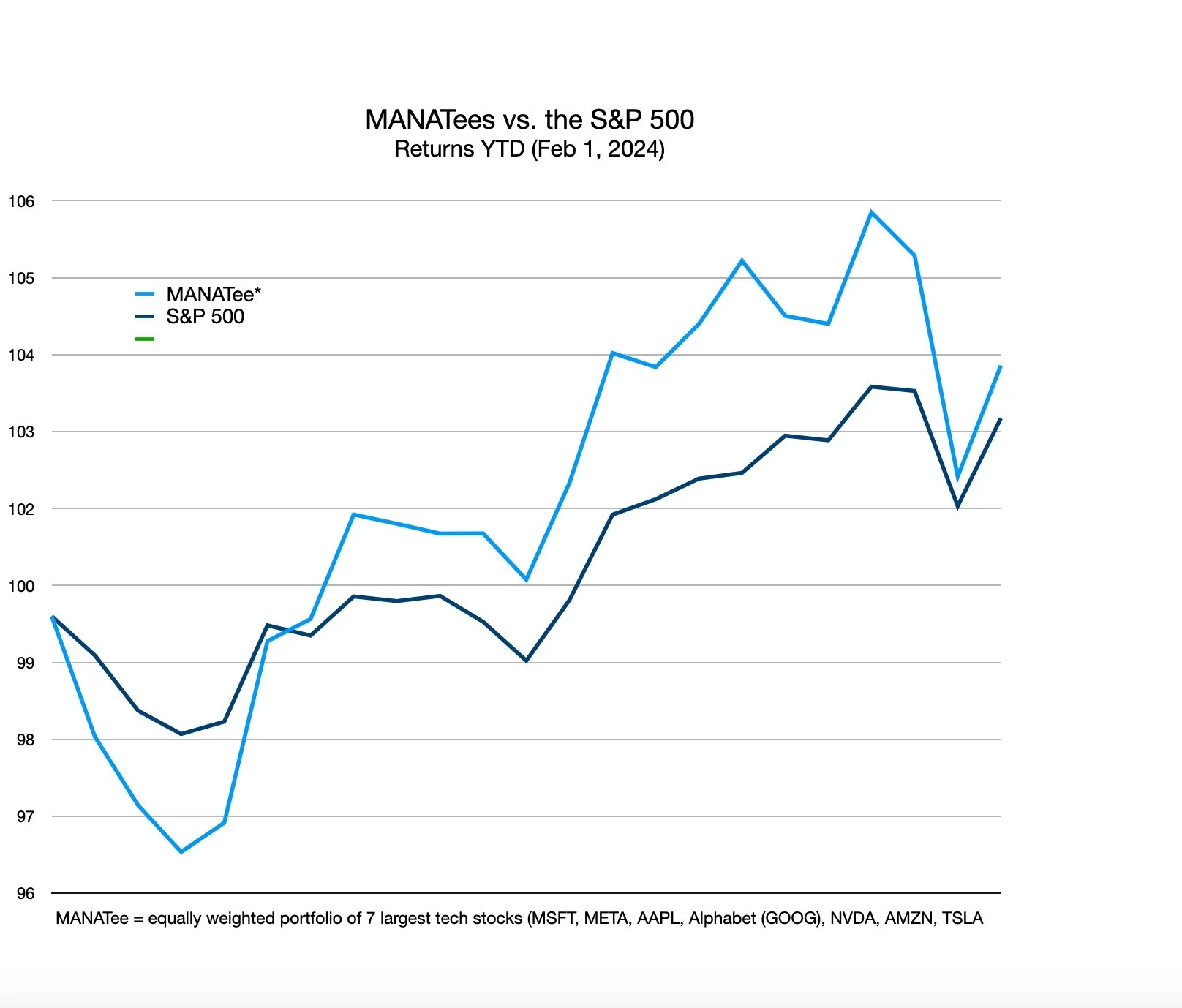

Manatee Performance

Earnings Highlights for Q4 2023

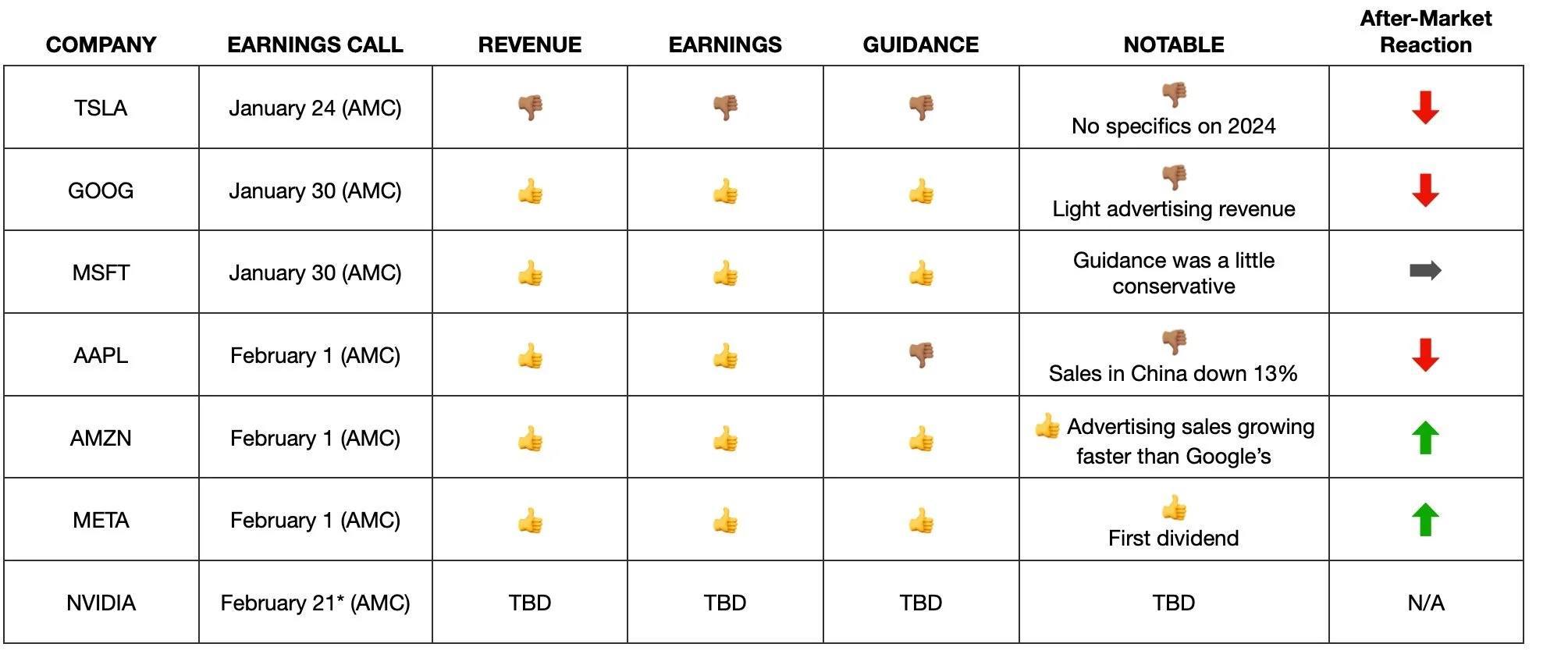

With the exception of Nvidia, all the MANATees have published their results for the December quarter of 2023.

Tesla (TSLA) was the first to report and the biggest disappointment. The company slightly missed on both revenue and earnings, but perhaps more importantly, management frustrated analysts with an unwillingness to provide clear and specific guidance on its price cutting strategy and anticipated profit margins.

Management says demand for the Cybertruck has been robust and that the challenge will be to ramp up supply to fulfill orders. An even larger challenge will be to launch a next-generation vehicle at the Gigafactory Texas before the close of 2024. Until then management warned that “vehicle volume growth rate may be notably lower than the growth rate achieved in 2023".

Tesla shares were down 12% the day after the call. Year to date the stock was down 27% vs. the S&P 500’s gain of 3%. (Fortunately, Tesla is the one stock among the MANATees that we have left out of our client portfolios).

Alphabet (GOOG) — AI was supposed to be Alphabet’s forte, but it might be responsible for the first tiny crack in the company’s mighty edifice — a slight miss in advertising sales. While the company beat analyst consensus estimates for both revenue and earnings, it was that shortfall in advertising sales relative to expectations that sent the stock down some 7% the next day. Is this a mere flesh wound? Or will advertising sales slide as AI-challengers continue to innovate around web-search?

Management also mentioned layoffs. At one point a company representative claimed “We're not restructuring because AI is taking away roles”. But the fact remains that the company is indeed taking away roles. Later on in the call the very same person spoke of “streamlining operations across Alphabet through the use of AI”. It looks like CEO Sundar Pichai is taking a leaf out of Zuckerberg’s playbook. 😳

MSFT (MSFT) Microsoft beat consensus revenue and earnings estimates, but perhaps investor enthusiasm in the weeks leading up to the earnings call was a little too frothy. The stock traded sideways after hours and down 1.4% the following morning.

While management raised guidance for the next quarter, many analysts considered it unexpectedly conservative. Intelligence Cloud revenue had sequential growth of 6.6% in the December quarter, but management is now guiding to just 1-1.5% sequential growth in the March quarter.

Amazon (AMZN) beat expectations on both the top and bottom lines. Top line growth was a brisk 12% year on year, but the 383% explosion in operating income was truly eye-watering! In the company’s breakdown of revenue, advertising sales stood out with annual growth of 27% — more than double the pace of Google’s 11% for the same line item.

Amazon took the opportunity to announce its newest product, Rufus, a talkative AI-powered shopping assistant trained on Amazon’s product catalog and the web. I imagine it will be like having a Best Buy employee lurking in the corner of your living room. 😂 I hope I’m wrong.

Apple (AAPL) finally returned to growth after 4 quarters of revenue decline — but just barely. Sales growth was just 2%. After factoring in inflation, that’s basically flat to down. And what’s more, it appears this “growth” might be short-lived: sales in China declined by 13% annually and currently account for 19% of Apple’s total revenue.

The discussion of the Vision Pro was a glimmer of light during the call, Apple’s first new product category since the Apple Watch launched in 2015. The starting price is a nose-bleeding $3,499, but Apple has already sold 200,000 units on pre-order. To my surprise, the Vision Pro does not seem to be just another set of VR goggles that will end up on my closet shelf with other expensive and long forgotten toys. The product reviews I’ve come across so far read like religious experiences. 🙏

Meta (META) stole the show this earnings season with surprisingly strong growth, optimistic guidance, and the declaration of the company’s first dividend. Meta also announced it will increase its share buyback program by $50 billion.

Zuckerberg’s year of efficiency ended with 22% fewer employees and a vastly improved operating margin of 41% vs. 20% the year prior. I hope those departing employees held on to their shares or diversified into the other Manatees 🦭🦭🦭🦭🦭🦭.

Meanwhile, the Reality Labs division continues to hemorrhage money. Since 2019 this unit has accumulated losses of $51.1 billion.

Nvidia (NVDA) hasn’t reported yet, but the increase in capital spending on AI for Alphabet, Microsoft and Meta certainly bode well for the company.

Financial Checkup - Test Yourself!

Take this short quiz to grade your financial health! Just one caveat: this quiz assumes you’re an employee of one of a big publicly traded technology companies (i.e. a company offering RSUs and a competitive 401k).

INSTRUCTIONS: Answer “YES” or “NO” to each question and then tally your score by counting the number of times you answered “YES”.

Do you have an RSU plan in place?

Do you fund a Mega Backdoor Roth every year?

Did you make employee contributions to your 401(k) of $54,750 in 2023? (Many people erroneously believe that the maximum employee contribution was $22,500 for 2023).

Do you have a revocable trust in place or some other form of estate planning?

Have you consolidated your old 401(k)s into an IRA?

Do you and all members of your household have Roth IRAs that they contribute to every year?

Has your investment portfolio generally performed as well or better than the S&P 500 over the long term without excessive concentration risk*?

Do you have an HSA?

If you have children, have you set up 529 plans and/or Roth IRAs for them?

Do you hold your high risk / high return assets (e.g. Bitcoin, tech stocks) in tax-efficient accounts that will avoid capital gain and income taxes?

*No company accounts for more than 20% of your portfolio. We’re assuming a slightly above average tolerance for risk, an assumption that will be adjusted for your particular circumstances.

SCORING: How many times did you answer “Yes”?

0-3. We can create a lot of value for you. Let’s talk.

4-5. Not too shabby, but there’s room for improvement! Let’s talk.

6-7. I’m impressed! If you’d like to explore the other 3-4 items, we’d be happy to speak with you. So let’s talk.

8-10. You are an inspiration! Have you considered a career in wealth management? Would love to consider bringing you on board as a partner. ;^)

If you have a score of less than 6, consider having a conversation with a financial advisor who caters to the needs of employees of big technology companies. We have 3 complementary consultations every week. First come, first serve.

Tactical & Practical - Hate taxes? Read this!

Last week I ran multiple choice test on Linkedin asking respondents whether they could guess the type of account that can avoid taxes altogether. Just one person answered correctly.

The correct answer? A Health Savings Account. It’s the only vehicle from the list above that can completely shield you from US taxes*. Kudos to Vijay Rao of Just Invest LLC for being the only respondent to select the right answer.

This is how it's done:

1. HSA contributions reduce taxable income. They are pre-tax.

2. Investment earnings in the account are not subject to tax.

3. Funds in the HSA left over at the end of the year can be rolled over from year to year.

4. Distributions from an HSA to pay for qualified medical expenses are also tax-free.

Making contributions to an HSA requires that you enroll in a high-deductible health plan: one with a deductible of at least $1,600 for an individual or $3,200 for a family as of 2024. If you’re an employee with one of the MANATees, this won’t be a problem.

For 2024, the maximum contribution is $4,150 for individual coverage and $8,300 for family coverage.

*Provided you are a US citizen or resident. (duh! ;^)

Is Google the Next Kodak? CEO Pichai Seems Perplexed.

In 1974 Kodak was the 3rd largest company in the S&P 500. Today the company holding that position is Google. In the 70s, Kodak commanded a 90% share of the American market for photographic film. Today Google controls roughly 90% of web search. In the mid-90s digital cameras upended Kodak’s business in photography film. Fast forward 30 years, and AI is beginning to disrupt web search. Will the similarities stop there?

A near-monopoly commanding 86–96% market share worldwide, Google dominates the search engine market. But it’s precisely the reliance on search for the majority of its revenue that makes Google vulnerable to any disruption in its core business. Unfortunately, it looks like AI may represent a sea change in the way we search for information.

Are you old enough to remember Kodak film? In the early 90s just about every shopping center had either a Kodak film processing counter or a Kodak drive-through where you could drop off and pick up your camera film. Fifteen years Kodak film was completely replaced by the digital camera.

It’s hard to believe that a Kodak employee created the first digital camera. Yes, you read that right. Kodak developed the technology that would eventually bring about its demise.

Similarly, Google is a queen bee of AI — one that has spawned a thousand AI innovators who are now busy trying to turn the market for search upside down (see table).

Google now finds itself in a classic innovator’s dilemma. Like Kodak, careful not to cannibalize its existing business, Google has been slow to innovate around AI and is playing catch up with contenders like ChatGPT and Perplexity who have nothing to lose.

In the Kodak example both the old technology (film and retail distribution) and the new (digital cameras) existed in the physical world. Both technologies were essentially types of hardware.

Fortunately for Google, web search and AI agents operate in the world of software and content. This gives Google a much better shot at adapting to the challenge. Nevertheless, we will be carefully monitoring Google to spot the first cracks in the mighty edifice of its search business.

Partial list of AI startups founded by former Googlers:

Uncharted Labs (David (Fengning) Ding, Charlie Nash, Yaroslav Ganin)

Adept (David Luan, Kelsey Szot)

Anthropic (Dario Amodei)

Character.AI (Noam Shazeer, Daniel De Freitas, Fred Bertsch)

Cohere (Aidan Gomez, Nick Frosst)

Inflection AI (Mustafa Suleyman)

Mistral AI (Arthur Mensch)

Neeva, acquired by Snowflake (Vivek Raghunathan, Sridhar Ramaswamy)

Perplexity (Aravind Srinivas)

Reka AI (Yi Tay, Cyprien de Masson d'Autume)

Sakana AI (Llion Jones, David Ha)

Samaya AI (Maithra Raghu)

Tonita (D. Sivakumar, Uma Mahadevan)

Vectara (Amin Ahmad, Amr Awadallah)

Remarkable Quotes

APPLE

Film director James Cameron on Apple’s Vision Pro:

“I think it’s not evolutionary; it’s revolutionary. I would say my experience was religious.”

TESLA

Elon Musk on the Optimus humanoid robot:

“When you think of an economy, economy is productivity per capita times capita. But what if there's no limit to capita? There's no limit to the economy.”

I mean, we're really building the future. I mean, the Optimus lab looks like the set of Westworld. Admittedly, that was not a super utopian situation.”— Elon Musk on the Optimus humanoid robot.

Elon Musk on Chinese automobile industry:

Frankly, I think if there are not trade barriers established, they will pretty much demolish most other car companies in the world. So they're extremely good.” —

Elon Musk on Tesla’s competitive advantage:

It does make it very hard to copy us because you have to copy the machine that makes the machine that makes the machine.

It's possible with the right architectural decisions that Tesla may in the future have more compute than everyone else combined.

ALPHABET

Philipp Schindler, SVP and CBO, Google, allaying concerns about AI driven layoffs:

We're not restructuring because AI is taking away roles, that's important here. But we see significant opportunities here with our AI-powered solution to actually deliver incredible ROI at scale —

AMAZON

Andy Jassy on Amazon’s acquisition of One Medical:

“My kids’ kids will not believe what the health care experience was for us.”

NVIDIA

Jensen Huang on the fine edge between success and failure:

"When you build a company from the ground up, you face adversity. When you experience nearly going out of business a few times, that feeling sticks with you ... I live in this condition of partly desperate, partly aspirational."

MICROSOFT

Satya Nadella on cyber threats:

"The world needs new international rules to protect the public from nation state threats in cyberspace. In short, the world needs a Digital Geneva Convention.”

META

Mark Zuckerberg to parents at Washington hearing on sexual exploitation of children:

“I’m sorry for everything you’ve all gone through.”

If You’d Like to Chat

If you'd like to discuss something specific or just get acquainted, I'm generally available for several meetings ever week - online or in person here in Silicon Valley. To set up a time, please tell us a little about yourself and set up an appointment on our website.

Subjects we often cover:

Thanks for reading Manatee Monitor!

Subscribe for free to receive new posts and support my work.

Disclaimer: This newsletter is the opinion of Matt Lewis and is made from the perspective of a US tax payer. TechView Wealth Advisors LLC does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction or tax strategy.