Mega Backdoor Roth — Supersized Retirement

When it comes to saving for retirement, most people turn to the 401(k) plan. They contribute just enough to get their company’s full matching contribution. Sometimes, they “max out” their contributions up to the basic contribution limit on pre-tax dollars. But they really haven’t maxed out their 401(k). Far from it!

Before we introduce the Mega Backdoor Roth, let’s quickly review the difference between the traditional and Roth portions of a 401(k).

Most people make only pre-tax contributions to their 401(k). When they do, they receive an income tax deduction in the amount of the contribution. The funds then grow tax-free until until they’re withdrawn in retirement, at which point the IRS will charge income tax on the disbursements.

The Roth feature of a 401(k) plan allows you to contribute after-tax dollars, which means you won’t receive a tax deduction up front. However, the funds in your account will grow tax-free, and even better, when you decide to withdraw the funds during retirement the IRS won’t be waiting for you.

Decisions, Decisions…

So, which one should you choose for your 401(k)? Pre-tax or after-tax contributions? It may depend on your individual circumstances. If you expect to be in a higher tax bracket in retirement than you are now, Roth contributions to a 401(k) would be your best option. However, if you expect to be in a lower tax bracket in retirement, a pretax contributions to the 401(k) would be the way to go.

Now let’s talk about the Mega Backdoor Roth.

What is a Mega Backdoor Roth?

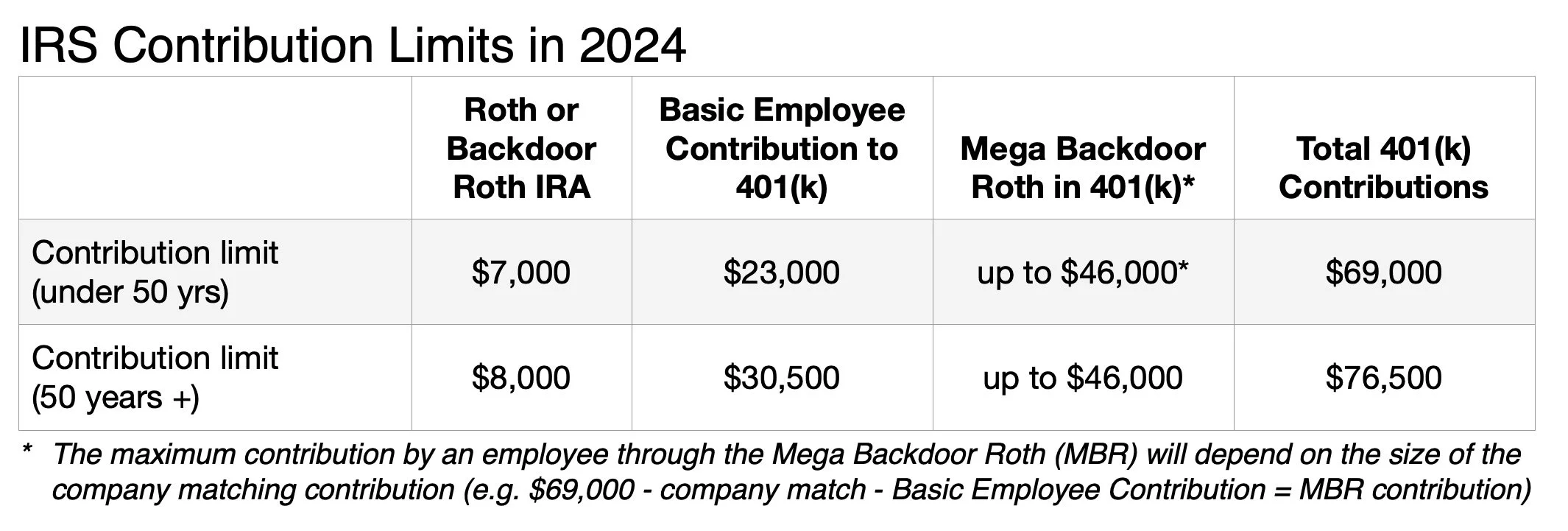

A Mega Backdoor Roth is a strategy that allows you to increase contributions to your 401(k) far beyond the the basic contribution limits. In the process, you’ll lower your taxes, too! What’s more, the contributions made through a Mega Backdoor Roth practically dwarf the contribution limits on the Roth IRA and its close cousin, the Backdoor Roth IRA (see Table).

Benefits of a Mega Backdoor Roth IRA

The Mega Backdoor Roth IRA can help you reach your retirement goals much faster and has many other benefits, too, including:

Larger contributions

No taxes on contributions or earnings

Tax strategy diversification

No taxes on early withdrawal of contributions

No required minimum distributions imposed by the IRS

Opportunity for greater compounding returns during retirement (see graph)

Step by Step Instructions

Setting up a Mega Backdoor Roth IRA can be little complicated in some companies, but it's worth the effort if you really want to maximize your retirement savings. Here are the steps to follow:

Make sure your 401(k) plan allows for after-tax contributions. Not all plans do, so check with your plan administrator.

Max out your basic employee contributions for the year ($23,000 in 2024, or $30,500 if you're over 50).

Make after-tax contributions (without exceeding the limit on total contributions to the plan from you and your employer — refer to table above).

Immediately convert the after-tax contributions to Roth status to avoid paying taxes on investment earnings.*

Repeat steps 2, 3 and 4 each year.

Work with your plan administrator to automate your contributions.

*Some companies like Apple have 401(k) plans that invest your after-tax contributions before you’ve had a chance to convert them to Roth.

Conclusion

Setting up a retirement savings plan can be daunting, but the Mega Backdoor Roth can really turbocharge your retirement savings and secure your financial future. It offers greater financial security during your working years and quickly opens up the possibility of an early retirement.

If you need assistance setting up a Mega Backdoor Roth IRA, please contact us to set up a free consultation. We can be especially helpful in tailoring a retirement strategy for individuals who receive RSUs or other forms of equity compensation. With a little bit of planning and effort, we can help you take control of your retirement savings and reach your financial goals.