Apple Benefits Resource Page

As an employee of Apple, you have many issues to consider in the management of your equity compensation, tax exposure, retirement planning and career development. By taking a holistic view across all aspects of your wealth, we create the optimal solution for your particular circumstances.

Aligning your RSU plan, tax deferred accounts, investment strategies and risk management policies, we create a whole greater than the sum of its parts so that you reach your goals with confidence and ahead of schedule.

Compensation Basics for Apple Employees

Apple compensates its employees through salary, RSUs and cash bonuses. In the absence of tax planning, all three are taxed at ordinary income tax rates.

Restricted Stock Units

Apple provides its employees with stock awards by way of restricted stock units (RSUs), which come in three forms:

Initial RSU grant

Annual stock refresher

Out-of-cycle bonus

Initial RSU Grants

Initial RSU grants are negotiated during the hiring process. At Apple, the most common vesting schedule calls for biannual vesting over 4 years. In other words, 8 equal amounts of RSUs vesting every 6 months - the employee receiving one share of stock for each vested RSU.

Ideally, Apple’s stock price will rise over the vesting period, so that the dollar value of the shares received rise over time (even though the number of shares has not changed). For example, here’s how the dollar value of the Apple RSU grant described above would have increased over the period of 2018-2021:

Stock Refreshers

Employees who begin working for Apple before April 1st will be eligible for stock refreshers in their first year. Otherwise, stock refreshers begin in the second calendar year of employment. Stock refreshers are determined by performance on a scale of 5 to 9 and are paid out once a year. Vesting follows the same schedule as most initial RSU grants: 8 vesting dates spaced 6 months apart over a total of 4 years.

Out-Of-Cycle Bonuses

Out-of-cycle bonuses are less predictable and are usually issued to exceptionally high-value employees who Apple considers targets for poaching by competitors.

Taxation of RSUs

RSUs are taxed as ordinary income upon vesting and as a capital gain or loss upon the sale of the shares received. To learn about RSU tax mistakes and how to avoid them, watch our video on RSU taxation.

Tax Withholding on RSUs

When RSUs vest, Apple sells a portion of the resulting shares to cover payroll taxes (social security, medicare, etc.) and withhold income taxes for the IRS and the employee’s state of residence. For those making less than $1 million dollars in annual supplemental wages, the withholding rate is typically 22% of the market value of the shares. However, this is often not sufficient to cover the employee’s tax liability to the IRS. It’s often the case that the employee must pay penalties in addition to the taxes not covered by withholding.

Apple 401(k)

The Apple 401(k) plan compares favorably with 401(k) plans of other major tech companies. But one unique feature of Apple’s plan is that the company’s matching contribution grows with the employee’s tenure at the company. For employees in their first 2 years of employment, Apple’s contribution is 50% of the employee contribution — up to 6% of eligible compensation. For employees employed more than 2 years and up to 5 years, Apple’s contribution rises to 75%. After 5 years of employment Apple’s contribution tops out at 100% (see table).

How we help Apple Professionals with their 401(k):

Advise you on the allocation of pre-tax and post-tax retirement savings to your 401(k) over traditional pretax, Roth and Mega Backdoor Roth contributions.

Guide you in planning and executing a Mega Backdoor Roth.

Optimize your savings each quarter so that you receive the full company match

Monitor investment performance and implement investment, savings, and tax-minimization strategies tailored to your long-term goals

Assist you in setting up and managing a self-directed brokerage account within your 401(k).

Establish a mix of passive and active investment strategies tailored to your particular requirements.

Apply our proprietary valuation models of leading technology stocks in the management of your portfolio.

Make use of risk management strategies with mechanical rules that minimize human emotion and error.

Apple Mega Backdoor Roth

The Apple 401(k) offers a Mega Backdoor Roth, which allows after-tax contributions to be converted to Roth. This conversion forever more shields investment earnings from income tax. In other words, qualified distributions from the account become entirely tax-free (both contributions and investment earnings).

Unlike the Roth IRA, which is capped at $7,000 in annual contributions as of 2024 ($8,000 for those 50 years and over), the Mega Backdoor Roth allows for much more substantial contributions in the tens of thousands of dollars — usually $30,000 or more.

Until recently, Apple’s process for setting up the Mega Backdoor Roth was labor intensive and inefficient. However, with Apple’s move to Fidelity from Schwab / Empower, it has become possible to essentially “set and forget” one’s contributions for a Mega Backdoor Roth.

And with a “self-directed account” at Fidelity, Apple employees can opt to have their account professionally managed by their financial advisor.

Self Directed Brokerage Account

Apple gives employees the option of setting up a self directed account in their 401(k) through Fidelity. The account offers a broad investment universe, including a variety of ETFs and individual stocks. Up to 90% of an employee’s 401(k) balance can be managed in such an account.

Should you choose to become a client of TechView Wealth Advisors, you can elect to have us manage your self-directed account in order to benefit from our expertise in investment management and tax planning.

Employee Stock Purchase Plan

Employee stock purchase plans offer an opportunity to purchase company shares with after-tax dollars at a discount to market value. At Apple, that discount is 15% to market value. The ESPP is made more lucrative still by a lookback provision that bases the employee’s pre-discount purchase price on the stock price at either the beginning or the end of a 6-month offering period, whichever is lower. The two offering periods run from Feb 1 to Jul 31 and Aug 1 to Jan 31, during which deductions are made from an employee’s paycheck and held in escrow.

Because of the lookback provision, employees participating in the ESPP may capture gains significantly higher than 15% (see Example). Consequentially, we usually advise our clients who work at Apple not only to participate in the ESPP program, but also to maximize, if possible, their contribution. Currently, the maximum annual contribution is either the IRS annual limit of $25,000 or 10% of gross income (excluding vesting RSUs and bonuses) — whichever is lower.

EXAMPLE

Date Stock Price

Feb 1 $110

Jul 31 $170

$20,000 / $110 (1-.15) = 213.9 shares

Pretax Profit = 213.9 (170 - 93.5) = $16,363 or 82%

Deferred Compensation Plan

Apple provides its Deferred Compensation Plan to non-employee directors, members of a select group of management and/or highly compensated employees, as well as employees designated by the Board of Directors as “officers”. Only those employees or non-employee directors notified in writing by Apple of their eligibility for the plan can participate.

Participating in Apple’s DCP potentially offers three types of tax benefits:

Lower current taxes by deferring salary and cash bonuses

Tax-deferred growth

Lower future taxes through the spreading of distributions over time

*Assumption: Employee resides in CaliforniaBy using Apple’s deferred compensation plan to defer $200,000 in salary and $100,000 in cash bonuses, the employee in this example has reduced current taxes by roughly $150,000.

Approximate tax savings: $150,000

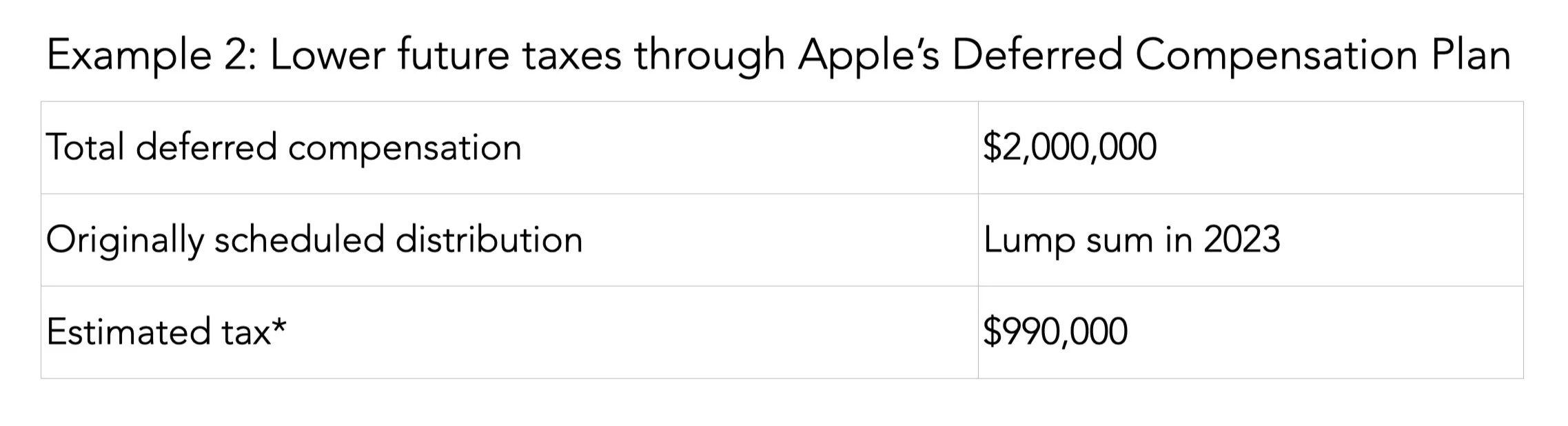

Receiving a lump sum disbursement of $2,000,000 in deferred compensation would expose the employee to the highest income tax bracket. Instead, the employee could spread distributions of total deferred compensation over a longer time horizon and enjoy lower income tax rates.

Approximate estimated tax savings: $320,000

Other important aspects of a Deferred Compensation Plan:

Enrollment period for salary deferment.

Enrollment period for bonus deferment

Constraints on when one must decide the timing of distributions

Investments available through the DCP

Company-based risks

Individual based risks

If you are eligible to participate in Apple’s Deferred Compensation Plan and would like to speak to an advisor with expertise on the above issues, please set up a time for a consultation and fit meeting.

How we assist with retirement planning:

Ensure that you invest in the most tax-efficient manner possible.

Advise you on the allocation of pre-tax and post-tax retirement savings to your 401(k) over traditional pretax, Roth and Mega Backdoor Roth contributions.

Guide you in planning and executing a Mega Backdoor Roth.

Assist in setting up and managing a 401(k) self-directed brokerage account.

Establish the appropriate mix of passive and active investment strategies tailored to your particular situation and goals

Provide you a customized client portal where you can monitor all your assets, liabilities, and financial plan.

If you would like assistance navigating the complexities of Apple’s employee benefits, schedule an introductory call with us.

Disclaimer

TechView Wealth Advisors is not endorsed by or affiliated with Apple. The information on Apple’s employee benefits plan is provided for educational purposes only. While we strive to provide insightful and up-to-date information on Apple employee benefits, TechView Wealth Advisors does not guarantee its accuracy.