Alphabet Benefits Resource Page

As a Google employee, managing your wealth involves numerous complex considerations. To ensure you achieve the best outcome, it's essential to adopt a holistic approach that encompasses all key aspects of your financial life.

Techview Wealth Advisors will help your create a cohesive financial plan by integrating your equity compensation, tax planning, retirement planning, and career risk mitigation strategies. Once these critical components are aligned, you’ll have a unified strategy that enhances your financial well-being — a whole greater than the sum of its parts.

This approach ensures that all aspects of your financial life work together seamlessly, providing you with peace of mind and a clear path to financial success.

Alphabet 401(k)

RSUs

Mega Backdoor Roth

Other Benefits

Getting the Most Out of Your Google Benefits

The Alphabet Employee Benefits Plan comes with powerful tools for building wealth. Unfortunately, most Google employees fail to take full advantage of these opportunities. Some are too busy to allocate the time and effort required to set up the proper systems, some lack the financial expertise, and some believe they can figure it out on their own.

As our client, you will have a comprehensive plan that harnesses the combined power of your 401(k), RSUs, and outside investments. When these tools work in concert, they become far more effective in helping you build wealth.

Our first consultation is always complimentary, so schedule a call today to make sure you get the most out of your Google benefits.

Alphabet’s 401(k)

Whether retirement is quickly approaching or over a distant horizon, our job is to ensure that you invest in the most tax-efficient manner possible. We will help you get the most from both pre-tax and after-tax savings so that you can turbo-boost your retirement plan.

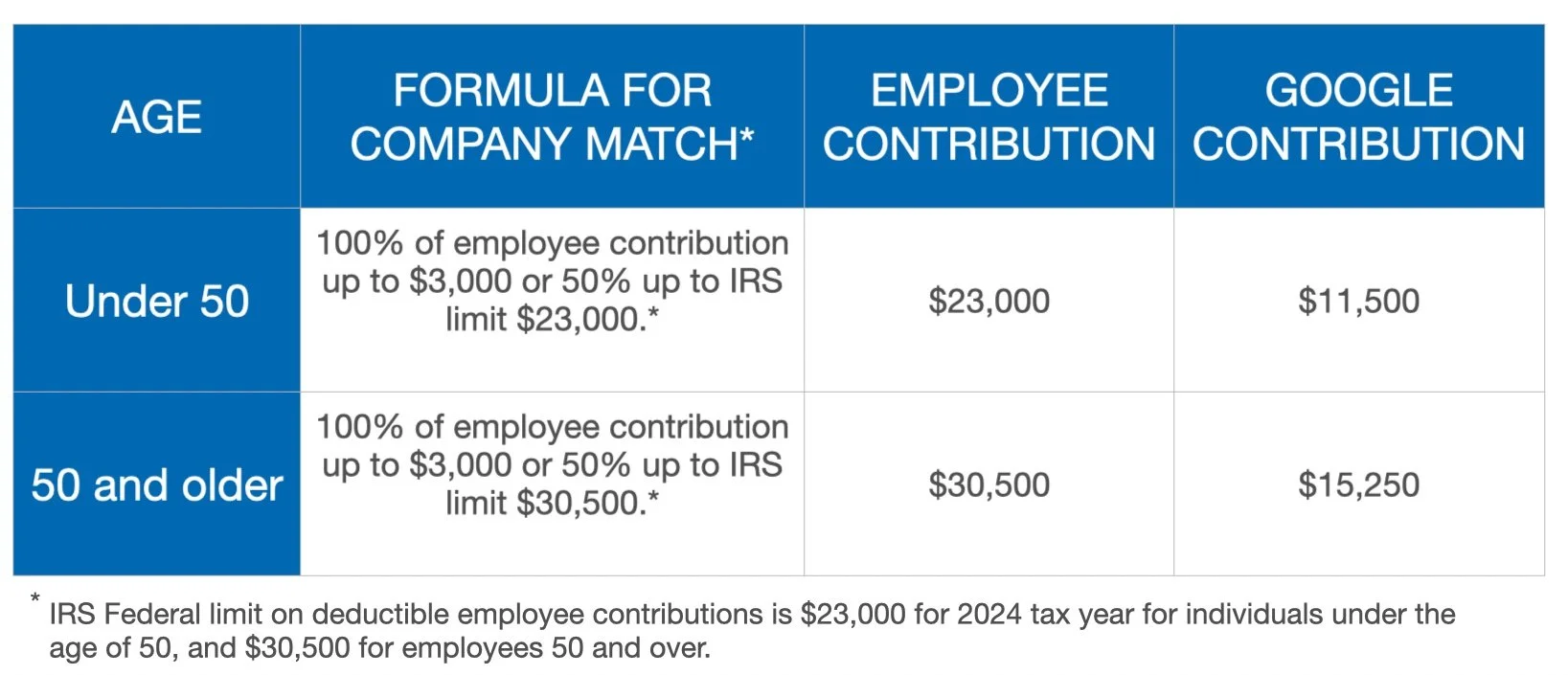

Alphabet’s Contribution Match

Alphabet will match 100% of your contributions to your 401(k) up to $3,000 or 50% of your contributions for elective deferrals ($23,000 in 2024), whichever is greater. If you’re 50 or older, the limit is $30,500 in 2024. Here are the minimum employee contributions necessary to receive the full match from Alphabet:

How we help Googlers with their 401(k):

Advise you on the allocation of pre-tax and post-tax retirement savings to your 401(k) over traditional pretax, Backdoor Roth, and Mega Backdoor Roth contributions.

Guide you in planning, funding, and managing the Mega Backdoor Roth.

Optimize your savings each quarter so that you receive the full company match

Monitor investment performance and implement investment, savings, and tax-minimization strategies tailored to your long-term goals

Assist you in setting up and managing a self-directed brokerage account within your 401(k).

Establish a mix of passive and active investment strategies tailored to your circumstances.

Apply our proprietary valuation models in the management of your portfolio.

Make use of risk management strategies with mechanical rules to minimize human error.

Compensation for Alphabet Employees

Alphabet (Google) compensates its employees in three ways:

1. Salary

2. Restricted stock units

3. Cash bonuses

Unfortunately, all three are taxed at ordinary income tax rates. However, the good news is that through tax planning, we can offer you resourceful ways to reduce this tax burden.

Tax Basics for RSUs

Google’s preferred instrument for equity compensation is the Restricted Stock Unit (RSU) — a promise to deliver shares at an agreed upon date in the future.

With RSUs, your first taxable event occurs when the RSU vests and you receive one share of stock for every RSU vesting. Since the stock you receive is a form of employee compensation that can immediately be sold (i.e. it’s not restricted stock), it will be taxed at your ordinary income tax rate — which is, unfortunately, your highest.

The second taxable event with RSUs will occur when you sell the stock. The sale is likely to trigger a capital gain, which will be taxed at either short term or long term rates, depending on whether you held the stock for over over a year. The tax rate for a short term capital gain will be equal to your income tax bracket for the year, while the tax on a long term capital gain will be 0%, 15%, 20%, or 23.8%, depending upon your total taxable income.

Mistakes with RSUs

Many Googlers make the mistake of not having an RSU plan. This inevitably leads to Google shares piling up. When such employees begin to think about selling Google shares, they may notice that the sale could trigger a short term capital gain. Since they’d rather qualify for the lower tax rate on long term capital gains , they often decide to postpone the sale until later. This soon leads to a vicious circle with even more Google shares piling up.

If the shares then appreciate, the employee will have been psychologically rewarded for doing nothing. In the end, the employee may decide the best course of action is to do nothing.

This is dangerous. As a Google employee, you already receive a significant portion of your livelihood in the form of salary. If you were to keep all your equity compensation in Google shares, you’d expose yourself to an extreme level of concentration risk.

What if AI challengers were to suddenly make Google search obsolete? Google might decide to embark upon a round of layoffs. Meanwhile, the stock may have plummeted.

Google has certainly been a sound investment over the years, but there are plenty of other attractive investments in the marketplace. We encourage our clients to allocate funds from their vesting RSUs to other investments in order to lower their concentration risk while boosting their risk-adjusted return.

To learn more about RSU tax mistakes and how to avoid them, watch our video on Google RSUs.

Tax Efficiency with RSUs

Selling company stock when RSUs vest comes with many benefits. Not only does the approach reduce concentration risk, streamline decision making, and cut down on procrastination. As an element of holistic planning, it can lower one’s overall tax burden, too.

By funding a portion of living expenses with funds from vesting RSUs, our clients are able to use their salary to fully fund a Mega Backdoor Roth. In many cases, this approach leads to a 100% increase in one’s retirement nest egg. To learn more about the Mega Backdoor Roth, please see the section below and watch the accompanying video.

Alphabet Mega Backdoor Roth

The Alphabet 401(k) offers a Mega Backdoor Roth, which allows after-tax contributions to be converted to Roth. This conversion forever more shields investment earnings from income tax. In other words, qualified distributions from the account become entirely tax-free (both contributions and investment earnings).

Unlike the Roth IRA, which is capped at $7,000 in annual contributions as of 2024 ($8,000 for those 50 years and over), Alphabet’s Mega Backdoor Roth allows for much more substantial contributions — up to $34,500 in 2024*.

And with a “self-directed account” at Vanguard, Alphabet employees can opt to have their account professionally managed by their financial advisor.

*Aggregate contributions from all sources - Employee’s "Elective Deferral" Contribution - Company Match = Maximum After Tax Contribution $69,000 - $23,000 - $11,500 = $34,500

Self Directed Brokerage Account

Alphabet gives employees the option of setting up a self directed account in their 401(k) through Vanguard. The account offers a broad investment universe, including a variety of ETFs and individual stocks.

As a client of TechView Wealth Advisors, you may elect to have us manage your self-directed account in order to benefit from our investment management services and, specifically, our expertise in tech monopolies.

Deferred Compensation Plan

Alphabet provides its Deferred Compensation Plan to non-employee directors, members of a select group of management and/or highly compensated employees, as well as employees designated by the Board of Directors as “officers”. Only those employees or non-employee directors notified in writing by Alphabet of their eligibility for the plan can participate.

Participating in Alphabet’s DCP potentially offers three types of tax benefits:

Lower current taxes by deferring salary and cash bonuses

Tax-deferred growth

Lower future taxes through the spreading of distributions over time

*Assumption: Employee resides in CaliforniaBy using Alphabet’s deferred compensation plan to defer $200,000 in salary and $100,000 in cash bonuses, the employee in this example has reduced current taxes by roughly $150,000.

Approximate tax savings: $150,000

*Assumption: Employee resides in CaliforniaReceiving a lump sum disbursement of $2,000,000 in deferred compensation would expose the employee to the highest income tax bracket. Instead, the employee could spread distributions of total deferred compensation over a longer time horizon and enjoy lower income tax rates.

Approximate estimated tax savings: $320,000

Other important aspects of a Deferred Compensation Plan:

Enrollment period for salary deferment.

Enrollment period for bonus deferment

Constraints on when one must decide the timing of distributions

Investments available through the DCP

Company-based risks

Individual based risks

If you are eligible to participate in Alphabet’s Deferred Compensation Plan and would like to speak to an advisor with expertise on the above issues, please set up a time for a complimentary consultation.

How we assist with retirement planning:

Develop a financial plan designed to help you achieve your life’s goals.

Ensure that you invest in the most tax-efficient manner possible.

Advise you on the allocation of pre-tax and post-tax retirement savings to your 401(k) over traditional pretax, Roth and Mega Backdoor Roth contributions.

Guide you in planning and executing a Mega Backdoor Roth.

Assist in setting up and managing a 401(k) self-directed brokerage account.

Establish the appropriate mix of investment strategies tailored to your particular circumstances.

If you would like assistance navigating the complexities of Alphabet’s employee benefits, schedule an introductory call with us.

Disclaimer

TechView Wealth Advisors is not endorsed by or affiliated with Alphabet. The information on Alphabet’s employee benefits plan is provided for educational purposes only. While we strive to provide insightful and up-to-date information on Alphabet employee benefits, TechView Wealth Advisors does not guarantee its accuracy.

Umbrella icon by Tomas Knop.

Other icons by Freepik.