THE BACKDOOR ROTH IRA (and how to avoid its pitfalls)

Free Money, Anyone?

Your biggest expense in life is likely to be taxes. Roth IRAs are a great way to shield yourself from taxes and really build wealth. If you follow the rules, the dollars in a Roth IRA are never taxed again.

Sadly, many high income earners mistakenly believe that IRS income limits have shut them off from this tax vehicle. While it may be true you can earn too much to qualify for a direct Roth IRA contribution, you could always go through "the back door" by taking advantage of a process known as a Backdoor Roth IRA.

Who is the Roth Backdoor Roth for?

The Roth Backdoor Roth is for you if you are either:

a single tax filer with a modified adjusted gross income (MAGI) of more than $144,000 in 2022 ($153,000 in 2023).

married and filing jointly, and your MAGI is over $214,000 in 2022 ($228,000 in 2023).

Follow Me Through the Backdoor

The Backdoor Roth is a two-step process:

Non-Deductible Contribution to an IRA - First you need to make a non-deductible contribution to an IRA. This means that you will not be able to lower your current taxable income by the amount of the contribution. For the 2022 tax year, you can contribute up to $6,000 to an IRA, or $7,000 if you’re 50 or older. (For the 2023 tax year, these figures increase to $6,500 and $7,500, respectively). To avoid the IRS taxing you on this after-tax contribution, be sure to fill out Form 8606 when you file your taxes.

“Convert” the contribution to Roth and transfer that sum to a Roth IRA - Get the necessary instructions and paperwork from your brokerage firm for the conversion. If you don’t already have a Roth IRA, you’ll need to open one before the conversion.

There’s Always a Catch

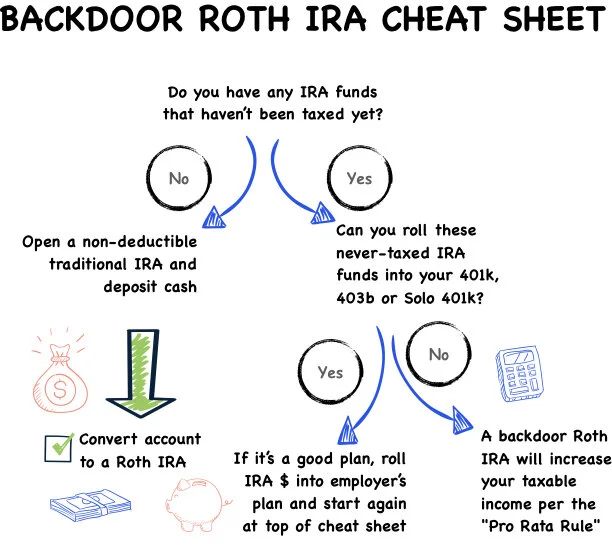

Here’s a catch you may want to avoid: the “Pro-Rata Rule”. When the non-deductible IRA is converted into a Roth IRA, the IRS runs a calculation to determine how much of that amount will be considered pre-tax and how much post-tax.

“What?”, you ask! “Didn’t I just fund the nondeductible IRA with after-tax dollars?”. Yes, you did. However, when you make a Roth conversion as part of the Backdoor Roth, the IRS will treat all your IRA accounts as one big IRA, tally up all the balances, measure the ratio of pre-tax to after-tax contributions and finally prorate the amount your converting. This could create an additional tax on the conversion.

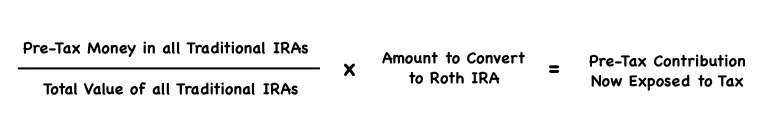

Here's the formula to figure out how much of the funds destined for your Roth IRA will end up as taxable income in the tax year of your contribution:

The Side Door Just before the Back Door

If you'd like to avoid paying tax now on account of the Pro-Rata Rule, you may have access to a workaround. That's because the IRS doesn't apply the Pro Rata Rule to balances in employer plans such as the 401k, 403b or Solo 401k. If you have such a company retirement plan, check to see whether roll-ins of IRA funds are allowed. If the answer is yes and the company retirement plan is of sufficient quality, you could first roll all your regular pre-tax IRA funds into your company retirement plan and later complete the backdoor Roth IRA without increasing your taxable income for the year.

Here's a cheat sheet to map it out visually:

Deadline for 2022 Contributions

The deadline for 2022 contributions to IRAs and Roth IRAs is Tuesday, April 18, 2023. You should give yourself at least a week’s lead time to set everything up.

Special Offer

If you need help with the process, we’re ready to take care of your Backdoor Roth for free, provided you’re among the first 5 people who request this service before April 11th, 2023.

~ Matthew Lewis, Private Wealth Advisor , TechView Wealth Advisors

Disclosures

Information provided reflects the views of TechView Wealth Advisors LLC as of the date of this document. Such views are subject to change at any point without notice. The information contained herein is for informational purposes only and should not be considered a recommendation to buy or sell any securities. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based on any information provided herein. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor's financial situation or risk tolerance. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses.