An Excellent Investment Under Your Very Nose?

It’s conventional knowledge that where there is no risk, there is no reward. How lucky for us that conventional knowledge is sometimes wrong! Over two hundred years ago Ben Franklin wrote “nothing can be said to be certain, except death and taxes”.

No argument there! But then wouldn’t it make sense to harness the certainty of taxes for our own benefit? Especially, if the risk of doing so is negligible or zero?

“What is he talking about?”

Well, if everyone’s default state is to pay the full amount of taxes due on investment profits, it stands to reason we could add value by simply using tax strategies to reduce the burden.

After all, there are so many people who earn superior investment returns only to lose a good chunk of it to bad tax planning. Whether you achieve your returns through stocks, startups, or real estate, tax planning can help you retain more of your hard-earned profits.

Three Powerful Tax Strategies

I’m based in Silicon Valley, so in this article I’d like to share three tax strategies that will be especially appealing to tech entrepreneurs and angel investors:

Roth IRA

QSBS

Time x Tax Savings = “T²”

An Angel’s Friend: The Roth IRA

Our brains are hard wired for imagery, so let’s start with a visual. Take a look at this chart that compares the after-tax returns of a Roth IRA with those of a regular brokerage account.

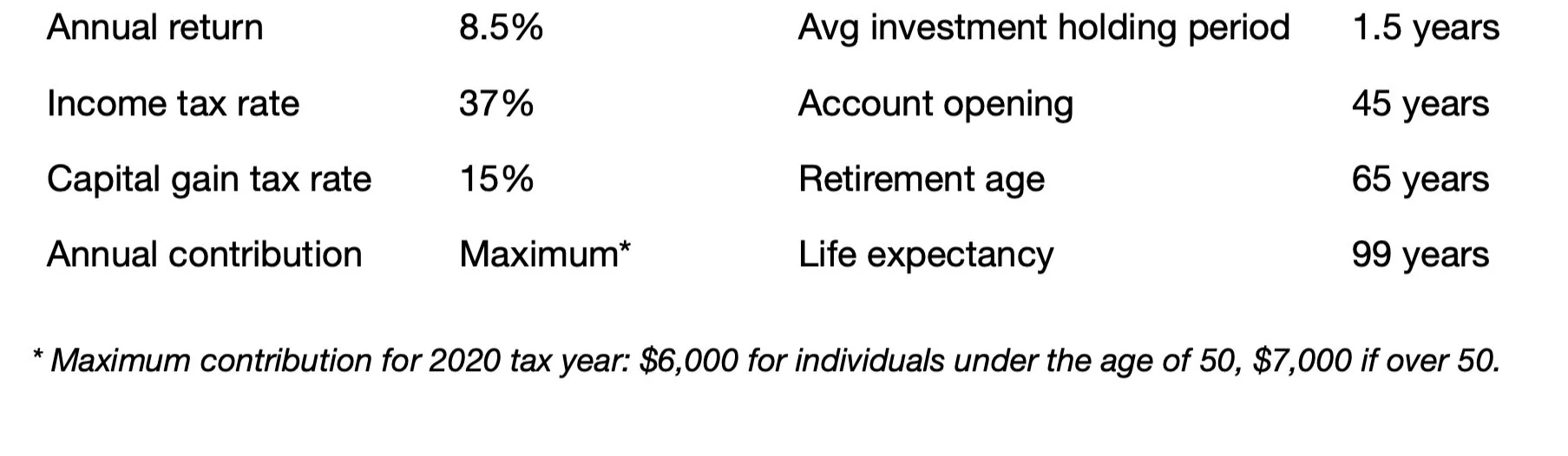

We’ve made some pretty straightforward assumptions to create this graph:

By the end of the holding period the Roth IRA reaches a value of $6.1 million dollars vs. $2.5 million in a regular fully taxable brokerage account. That’s a multiple of 2.4x over and above the entire taxable account, including its profit — all this for deploying a simple form of tax planning!

Remember, the Roth IRA is funded with after-tax contributions, so if you simply follow the rules none of your earnings or withdrawals will ever be taxed.

You angel investors out there, just imagine if you had used a Roth IRA to invest in your multibagger startups? That’s exactly how Peter Thiel and Max Levchin created their jumbo Roth IRAs.

In our example we used an average return of 8.5%, but many of you achieve higher returns when investing in private startups. The Roth IRA will deliver greater value compared to a taxable account as the rate of return increases. This is why it’s generally preferable to place high risk-high reward investments in a Roth IRA.

Do keep in mind, however, that to invest in private startups, real estate, or cryptocurrencies through a Roth IRA, you need to use a custodian that will allow you to hold such alternative assets in your account (commonly referred to as a “self-directed IRA”).

Roth IRAs have other benefits, too. For one, they compare favorably with traditional IRAs.

Roth IRA vs. the traditional IRA

No penalty or taxation on withdrawal of contributions for Roth IRAs*

No minimum required distributions for a Roth IRA.

First Home Purchase Exception. The Roth IRA allows the withdrawal of up to $10,000 of earnings tax free for a “first time home purchase”, provided you’ve had the Roth for more than 5 years**.

* This general rule does not apply to conversions.** The definition of a “first time home buyer” is broad. It applies if you or your spouse haven’t owned a principal residence at any time during the past two years. However, this exception does not apply if your Roth IRA was converted from a traditional IRA (i.e. a “Backdoor Roth”).I’d like to make just one more comment before moving on to our next tax strategy. Many people are under the false impression that Roth IRAs are off limits for high earners. Yet another piece of conventional wisdom that turns out to be wrong!

But one need not go through the front door to make a contribution to a Roth IRA. If your income is above the IRS income limits for a Roth, you can go the long way and take advantage of the Back Door Roth IRA.

Qualified Small Business Stock

Most startup founders have never heard of Qualified Small Business Stock. And yet this tax status could potentially save them millions of dollars. The value of QSBS lies in its ability to reduce tax on capital gains, provided certain requirements are met. Let’s start by providing another visual example.

There are two scenarios behind the graph, the only difference being the choice of legal entity.

As you may have deduced from our example, QSBS requires that a C-Corp issues stock. Other key requirements include:

the stock you receive must be issued by a domestic C-Corp whose gross assets at the time of issue were less than $50 million

you must hold the stock form more than 5 years

you must acquire the stock directly from the company at its original issuance and not on the secondary market

you must not hold the stock via a C-Corp.

your company must operate a qualifying business (almost all tech startups qualify)

In our example, this CTO could have saved $5.6M with a little tax planning. Sadly, many entrepreneurs actually qualify for QSBS treatment but don’t receive any benefit from this tax exemption because they’re simply unaware of its existence!

Time x Tax Savings = T²

Albert Einstein is purported to have said that “compound interest is the most powerful force in the universe.” Whether or not Einstein actually said anything about compound interest, it certainly is a force to be reckoned with. I do know that Mick Jagger once sang “Time is on my Side”. :^) I couldn’t agree more with Mick. Even a small difference in return compounded over multiple periods can achieve astonishing results. Let the numbers speak for themselves:

(1.0)³⁶⁵ = 1.0 (1.01)³⁶⁵ = 37.8

To be fair, let’s look at the compounding of negative returns through bad investments or overspending:

(.99)³⁶⁵ = .03

Astonishing, don’t you think? Clearly, there appears to be a large financial reward available to those of us who can begin coupling compound interest with positive investment returns at an early age.

And what if we were to do this in a tax advantaged account? That’s what I call T²!

Here’s a remarkable example. Imagine 401(k) plans were available in the 1930s. Three brothers, Moe, Larry and Curly, each agree to set aside a $1,000 a month for retirement. Each does this for 10 years, investing at an annual return of 8%, and letting the funds compound until retirement at age 65. That’s $120,000 invested over 10 years.

However, Moe starts saving at age 45, Larry starts at age 35, and Curly starts at age 25. Again, each puts away the same amount of money, $120,000 — the only difference being when each starts and how long the money is allowed to compound. How did they do?

Look how far ahead Curly is! His retirement savings dwarfs that of Larry’s and Moe’s. My hope is that this playful illustration will motivate you to harness the power of compound interest. The main takeaway is to start saving and investing as early as possible. If you’re not on the bandwagon yet, that means now!

But perhaps this example has you feeling you’ve “missed the boat” because you failed to start saving early. Don’t despair! It’s never too late to start!

And look on the bright side. You could start a Roth IRA for your loved ones — your children or your grandchildren. Yes, it’s possible! Stay tuned for our upcoming article on Roth IRAs for minors.

DisclaimerInformation provided reflects the views of TechView Wealth Advisors LLC as of the date of this document. Such views are subject to change at any point without notice. The information contained herein is for informational purposes only and should not be considered a recommendation to buy or sell any securities. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based on any information provided herein. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor's financial situation or risk tolerance. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses.