2023 - Year of the MANATees

The MANATee Monitor - News, tips, & advice for employees of the new FAANGs: Microsoft, Meta, Apple, Nvidia, Alphabet, Amazon & Tesla

Table of Content

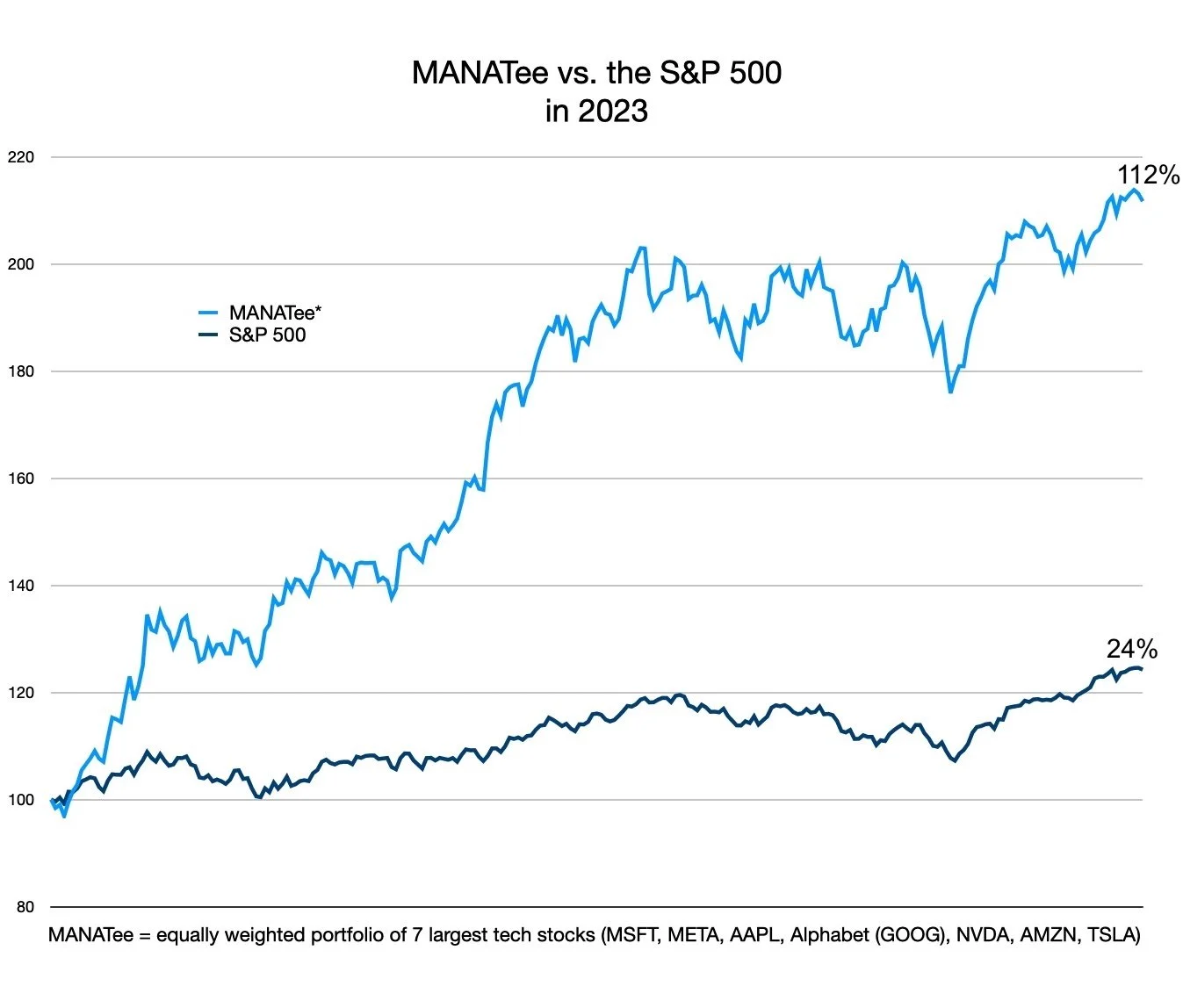

MANATees Dominate the S&P 500

The seven big tech stocks, the MANATees*, were the engine behind stock market performance in 2023, generating a whopping annual return of 112% on an equally weighted basis. This compares to a 24% return for the the S&P 500.

But let’s not forget how painful 2022 was for tech stocks. In that year the MANATees were down a massive 48%. If you had kicked off 2022 by investing $100,000 evenly across the MANATees, you would have just $109,000 at the end of 2023 - an annualized return of just 4.4%. That puts things in perspective. They say “Don’t fight the Fed” for a reason. That was definitely the advice to follow in 2022.

The MANATees may have been on a roller coaster ride over the last two years, but these 7 tech stocks have performed exceptionally well over the long term. I suspect that is because each possesses monopolistic qualities that present formidable barriers to entry for any would-be challengers.

This is the primary reason why Techview Wealth Advisors emphasizes the MANATees in its client portfolios. To this strategy we add additional layers of value such as:

rebalancing positions as individual stocks become historically dear or cheap

staying abreast of tectonic shifts in the competitive landscape.

Now let's see what 2024 brings!

P.S. - I'm cautiously optimistic.

*MANATees = Microsoft, Meta, Apple, Alphabet (Google), Nvidia, Amazon, TeslaA NEW ASSET CLASS? 🦭🦭🦭🦭🦭🦭🦭

You may have "periodical tables" of annual asset class returns before, but the one below is different for two reasons. First, we've included Bitcoin. Second, we've introduced an equally weighted portfolio of the MANATees (MSFT, META, AAPL, GOOG [Alphabet], NVDA, AMZN & TSLA).

*MANATee = equally weighted portfolio of Microsoft, Meta, Apple, Alphabet (Google), Nvidia, Amazon, Tesla

Two things immediately stand out:

Bitcoin's position at the very top or bottom for each of the last 10 years

the MANATees' almost freakish consistency as №2 in the pecking order of investment returns (with the notable exception of 2022, when the Fed raised rates at unprecedented speed).

One could make the argument that Bitcoin deserves a place in investment portfolios. That said, it may be prudent to limit one's exposure to Bitcoin on account of its hight volatility, regulatory risk, and as Warren Buffett has pointed out, the fact that "crypto doesn't produce anything". 😂

One could also make the argument that there's something about the MANATee stocks that sets them apart from the rest of the stock market. I believe it's there monopolistic qualities. In any event, the outperformance of an equally weighted portfolio of MANATee stocks vs. the vast majority of other asset classes, along with the portfolio's consistent position as the 2nd most profitable "asset class", suggest that these technology behemoths deserve a prominent allocation in investment portfolios. That is precisely why we focus on MANATee stocks and tailor our services to the needs of the professionals working for these world-renowned companies.

Meta's Year of Efficiency Powered by Layoffs

In what might be described as a strategic game of musical chairs, Meta, the parent company of Facebook, Instagram, and a burgeoning metaverse dream, slogged through a remarkable 24% drop in its workforce over the course of 2022-2023. With a headcount that now seems to be a rollercoaster about to reverse course, Mark Zuckerberg dubbed 2023 the "year of efficiency" for Meta. Nothing says 'efficient' quite like waving goodbye to thousands of employees.

What's the reward for such severe downsizing? Well, to some extent, it's the reason Meta's stock price has soared 313% since October 2022. Now if only Meta's bets on augmented reality could begin to pay off! Unfortunately, the Reality Labs division continues to hemorrhage cash, having amassed a cumulative loss of $46.5 billion since 2019. 🤯

Other tech behemoths like Google, Microsoft, and Amazon have had their share of layoffs, too, but the cuts have not been nearly as severe as Meta's

On the brighter side 😎, over the last 18 months the remaining MANATees, Nvidia, Apple, and Tesla, managed to avoid layoffs altogether.

LAYOFF LOOKOUT FOR Q1 2024

Google and Amazon are kicking off 2024 by resuming layoffs, albeit at a slower pace than in 2023. On the evening of January 11, 2024 Google laid off hundreds of workers in several divisions:

Google's core engineering division

Google Assistant (a voice-operated virtual assistant)

hardware division making the Pixel phone, Fitbit watches, Nest thermostat.

Google made a statement that most of the hardware cuts were made across teams working on augmented reality.

On the same day Amazon announced layoffs in its Twitch and Prime Video divisions. According to an internal note also sent on January 11, the company is laying off several hundred employees in its streaming and studio operations. The announcement was joined the same day by a statement from Twitch, a subsidiary of the e-commerce giant, disclosing lay offs affecting 35% of its workforce, or 500 employees.

Practical & Tactical: Dazed and Confused about IRAs and Roths?

There is so much confusion about retirement plans - especially when it comes to contribution and income limits to retirement plans. Even the likes of financial powerhouse Fidelity can sometimes get it wrong (see an example in the next article).

To contribute to an IRA or a Roth IRA?

First of all, let it be known that anyone with earned income can make a contribution to a Roth IRA, no matter how high their income level. This holds true for everyone - even Warren Buffett and Elon Musk. The twist is that above a certain income level it becomes necessary to make a contribution to a Roth IRA through a Backdoor Roth.

The Eternal Question

Many people have trouble deciding whether to contribute to a regular IRA or a Roth IRA. If your primary goal is to boost your retirement savings, I suggest you consider the Roth. Why? Because you'll have end up with more money in retirement.

Here's an example. Let’s say you contribute $7,000 to a Roth (the maximum contribution allowed in 2024 across all your IRAs and Roth IRAs if you're under the age of 50). Meanwhile, your identical twin contributes the same amount to a regular IRA. Let’s assume the two of you make the same investments, are in the same income tax bracket of 33%, and that the initial investment of $7,000 has grown to $100,000 by age 73. If you withdraw the funds from your Roth, you won’t owe any taxes and will receive the full $100,000.

Your brother, however, will end up with just $67,000 when he withdraws from his IRA. This is because his initial $7,000 contribution was made before tax, whereas your $7,000 contribution was after tax. The difference may seem trivial now, but it will make a world of difference during retirement!

Are You Really Maxing Out Your 401k?

Did you know that many people think they're maxing out their 401(k), when in reality they're not even close? The maximum employee contribution to a 401(k) in 2024 is $69,000 less the amount your employer contributes. For example, if you're under the age of 50 and work at Google, Microsoft, or Meta, your maximum employee contribution for 2024 would be $57,500*. That's a lot more than the $23,000 mentioned in Fidelity's literature! 😂

Remember, of that $57,500 maximum employee contribution, you could elect to make the first $23,000 a pre-tax contribution, but above that threshold your contribution would have to be after-tax. Don't make the same mistake as many others and make sure you're truly maxing out your 401(k) contributions.

* Note: The maximum 2024 company match to a 401(k) plan at Google, Microsoft, or Meta is $11,500. The maximum employee contribution at these companies would therefore be $69,000 - $11,500 = $57,500.

New Taxes for West Coast Tech Hubs 😢

The issue of taxing the wealthy has once again taken center stage, this time in the technology-driven economies of California and Washington state.

By Gage Skidmore, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=79572332

Washington's Supreme Court recently issued a ruling affirming the constitutionality of the state's 7% capital gains tax, implemented just two years ago. It's noteworthy that this ruling coincides with President Biden's FY24 budget proposal, which aims to nearly double the national capital gains tax rate.

Additionally, a recent survey suggests that most Seattle voters are supportive of a proposed citywide capital gains tax. If this proposal were to become law, it would mirror the statewide capital gains tax, impacting the sale of stocks and bonds exceeding $250,000 in a year. While such measures may be seen as addressing income inequality, high income earners may choose to follow Jeff Bezos's example and simply leave the state.

Meanwhile, California has raised its highest income tax bracket from 13.3%, which was already the highest in the nation, to a staggering 14.4%. To add to the concerns, there have been several proposals in recent years aiming to push this top rate even higher, potentially reaching a daunting 16.8%.

The newly introduced 14.4% rate is primarily a result of the absence of a cap on California's 1.1% employee payroll tax for State Disability Insurance. This translates to a top rate of 14.4% for individuals earning over $1 million starting January 1st, 2024.

For what it's worth, the 1.1% tax hike does not apply to capital gains, so the 13.3% rate for capital gains still prevails (already the highest among the 50 states).

IRS RAISES CONTRIBUTION LIMITS FOR 2024

Saving for retirement just got better! The IRS has raised the contribution limits on IRAs and Roth IRAs for 2024. If you're under 50, you can contribute up to $7,000, and if you're 50 or older, you can contribute up to $7,500. That's an increase of $500 from last year.

Want to maximize your savings? Consider a Roth IRA. With the funds already taxed before they go into the Roth, you'll end up with more savings in retirement than with a traditional IRA. That's because the $7,000 contribution limit applies to both pre-tax (IRA) and after-tax (Roth IRA) contributions.

If you're worried about income limits, don't be! You can always get around them with a "Backdoor Roth." Contact us for help with your Backdoor Roth contribution. Let's make the most of your retirement savings! 💰🌟

LET'S MEET UP IN SILICON VALLEY

If you'd like to get acquainted over a coffee or specifically discuss something of financial nature, I'll be in Silicon Valley the remainder of January and am available to meet per the schedule in the table below. To set up a meeting, please use my link to my Calendly.

Subjects often covered at these meetings:

January - February 2024

Hope you enjoyed this issue! Subscribe here and we'll e-mail you the Manatee Monitor a few days early the next time we publish.

Cheers,

Matt

Disclaimer: This newsletter is the opinion of Matt Lewis and is made from the perspective of a US tax payer. TechView Wealth Advisors LLC does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction or tax strategy.