The Path to Wealth

Techview Wealth Advisors focuses on investments in big tech like the Magnificent 7 and other emerging stealth monopolies . As our client, you will place yourself on the path to long-term wealth through a combination of:

Regular savings

Investments in stealth monopolies

Consistent contributions to tax-shielded accounts

Compounding returns over a long investment horizon

Why We Specialize in the ‘Magnificent 7’

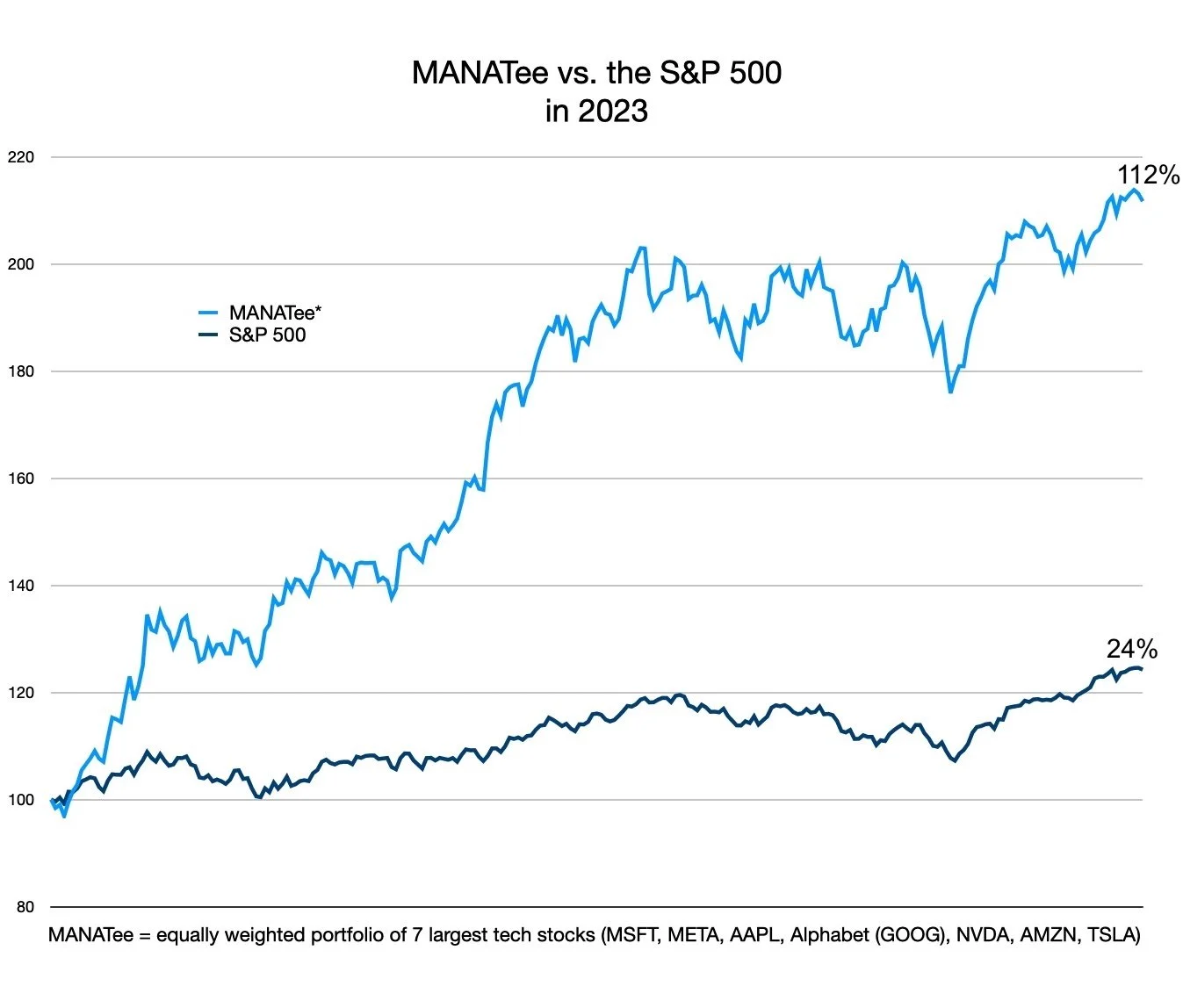

Investing in big tech stocks like the ‘Magnificent 7’ – Meta, Microsoft, Apple, Amazon, Nvidia, Google, and Tesla – presents a compelling case for investors seeking long-term growth and relative stability (see Figures 1 and 2 below). While there are some new ETFs designed to give exposure to the Magnificent 7, we rely upon our own proprietary research to allocate capital to these 7 stocks and other stealth monopolies that we have identified. We have also created a “MANATee index” to measure the returns of an equally-weighted portfolio of the Magnificent 7 stocks over time (Figures 1 and 2).

‘MAGNIFICENT 7’ 2023 Performance

*MANATee = an equally weighted portfolio of MSFT, META, AAPL, AMZN, NVDA, Alphabet (GOOG), TSLA

Disclaimer: The information provided in Figures 1 and 2 is for educational purposes only and should not be considered investment, legal or tax advice.

Stealth Monopolies

All of the Magnificent 7 display monopoly-like qualities in their respective markets. Such market dominance lays the foundation for sustained revenue growth and profitability. In turn, greater operational consistency translates into a track record of robust investment returns and outperformance relative to the overall stock market.

Stability

Over the long term, the Magnificent 7 provide a relatively stable set of investment growth opportunities versus companies that lack monopolistic qualities. Their market dominance provides some cushion from economic downturns and sector-specific volatility. And the semi-permanence in the marketplace is a key factor for investors interested in combining lower risk with appreciable capital growth over a long term investment horizon.

Innovation

All the M7 companies maintain large R&D budgets so that they can stay at the forefront of technological advancements. Expenditures on R&D not only enable them to keep their competitive edge but also help them launch new products and generate new revenue streams. For investors, this affords exposure to transformative technologies that can shape market trends and drive growth.

While no investment is without risk, the 'Magnificent 7’ and other emerging ‘stealth monopolies’ represent a convergence of growth, stability, and innovation — making them a compelling choice for those seeking to build a resilient and forward-looking investment portfolio.

For Prospective Clients

If you're considering our services and wish to evaluate our performance before entrusting us with all your investment accounts, we can discuss managing a portion of your portfolio initially.

This arrangement allows you to directly observe how our expertise and service quality stand out in comparison to our competitors.